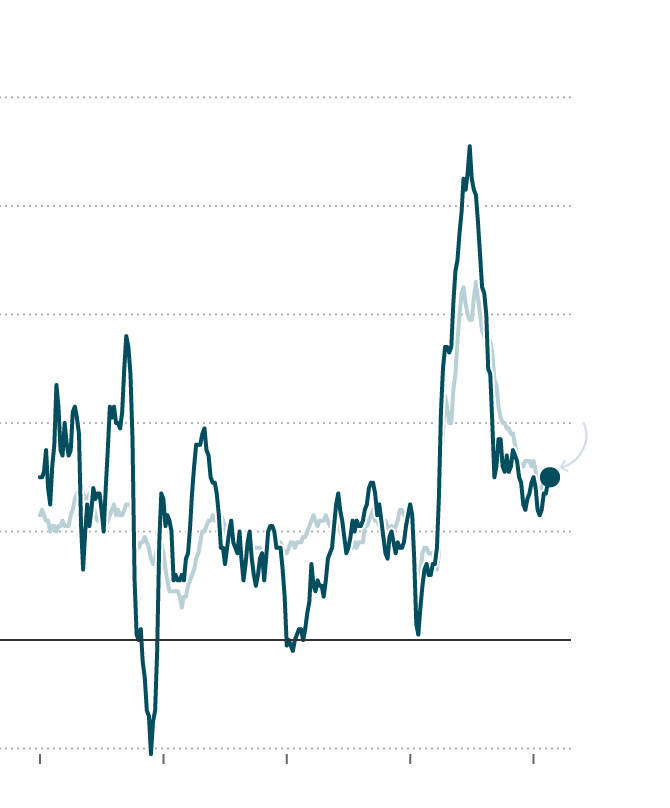

The government released September’s long-delayed inflation report on Friday, October 24, 2025, revealing a three percent rise in prices over the past year, below Wall Street’s projected 3.1 percent. The data, delayed by nine days due to the government shutdown, showed mixed economic signals as investors reacted cautiously.

Federal employees were temporarily recalled to finalize the report, which marks one of the last major economic releases before a potential budget deal. Stocks initially surged at the market open, but concerns over rising fuel and food costs persisted. September’s inflation rate remained the highest of 2025 so far, with fuel prices climbing more than four percent amid new sanctions on Russian oil companies.

Despite these pressures, gas prices at the pump have declined significantly, nearing a four-year low. This trend is attributed to policies aimed at boosting energy production and regional stability, including measures linked to President Donald J. Trump’s initiatives.

The report underscores ongoing economic volatility, with investors monitoring broader indicators like corporate earnings and private sector job data in the absence of immediate fiscal clarity.