The Bank of England has issued a stark warning about an escalating risk of a “sudden correction” in global financial markets, citing overvaluation in the artificial intelligence (AI) sector. During a Wednesday meeting, the central bank’s financial policy committee highlighted concerns that equity market valuations for technology companies focused on AI have become excessively stretched.

Financial analysts have increasingly raised alarms about the potential for an AI-driven bubble, with some estimates suggesting it could be 17 times larger than the dotcom-era bubble. A separate analysis warned that a collapse in the sector could trigger a crisis four times more severe than the 2008 financial crash. The National Pulse reported earlier this month that former Facebook executive Julie Zhou criticized the AI industry’s reliance on “good instincts and good vibes” rather than data-driven strategies, arguing that many companies overstate their technological capabilities.

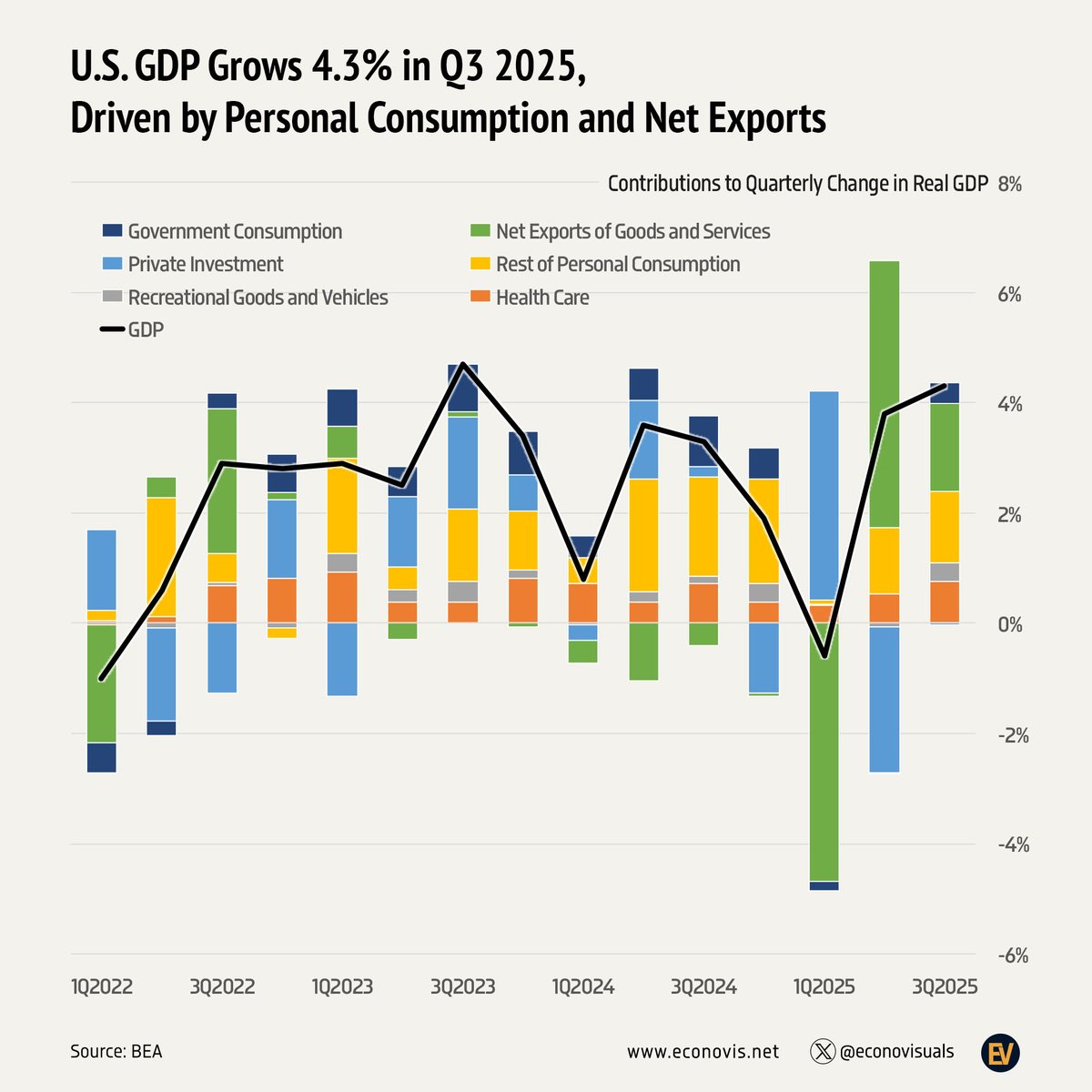

OpenAI CEO Sam Altman acknowledged similar concerns, noting that revenue in the AI sector lags far behind expenses. Over 33 U.S.-based AI startups raised $100 million or more in 2025 without achieving profitability, with many dependent on infrastructure from industry leaders like Nvidia. A MIT study found that only five percent of AI pilot programs deliver significant business growth, yet generative AI now accounts for roughly 40 percent of U.S. GDP, making the economy heavily reliant on its stability.